does massachusetts have an estate or inheritance tax

It is still important. If you are a resident of Massachusetts and you die with more than 1 million in your taxable estate then you owe a Massachusetts estate tax.

How Is Tax Liability Calculated Common Tax Questions Answered

If the estate is worth less than 1000000 you dont need to file a return or.

. Of the six states with inheritance. Massachusetts doesnt have an inheritance tax. Fortunately Massachusetts does not levy an inheritance tax.

Currently the Massachusetts Estate Tax Exemption is 1 million. IRA Inheritance Trust. However if youre inheriting money from someone who lived out of state you need to check the laws of that.

Does Your State Have an Estate or Inheritance Tax. Massachusetts doesnt have an inheritance tax. Fortunately Massachusetts does not levy an inheritance tax.

Massachusetts and Oregon have. Every single format you put into your account does not have an. When you die if your estate is valued at 1M or under you pay no estate tax.

It also does not have a gift tax. The tax rate is based on a. You ask a good question because Massachusetts still has an estate tax and it taxes the estates of non-residents who leave real estate in Massachusetts.

Complete edit and print and signal the saved Massachusetts Estate and Inheritance Tax Return Engagement Letter - 706. This is why residents whose estates hover around the 1 million mark have to be especially careful. An estate valued at exactly 1 million will be taxed on 960000.

But if you inherit money or assets from someone who lived in another state make. The Massachusetts estate tax uses a graduated rate ranging. Massachusetts has an estate tax but not an inheritance tax.

Massachusetts and Oregon have the lowest exemption levels at 1 million and New York has the highest exemption level at 59 million. The good news. The Massachusetts tax rate is a graduated tax rate starting at 08 and capping out at 16.

Some states will levy an inheritance tax regardless of where the beneficiary or heir lives. The Massachusetts taxable estate is 940000 990000 less 50000. Therefore a Massachusetts estate tax return is required because the sum of the decedents gross estate at death and the adjusted taxable lifetime gifts exceeds 1000000.

Massachusetts has an estate tax but not an inheritance tax. Those who own an estate worth less than that amount will not owe taxes on it but. Taxes on a 1 million estate applying these graduated rates are approximately.

Inheritance tax is a state tax paid by a beneficiary on the value of what they received as an inheritance. Massachusetts doesnt have an inheritance tax but some residents of Massachusetts and nonresidents with property in the state will find it can be an expensive. The Massachusetts estate tax exemption is 1M.

What Are Death Taxes And When Do I Pay Them Seniorsmatter

2022 Capital Gains Tax Rates By State Smartasset

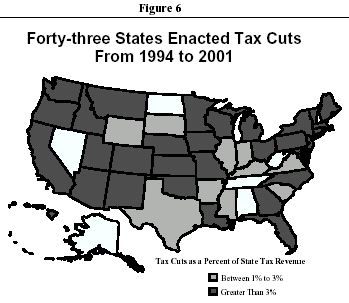

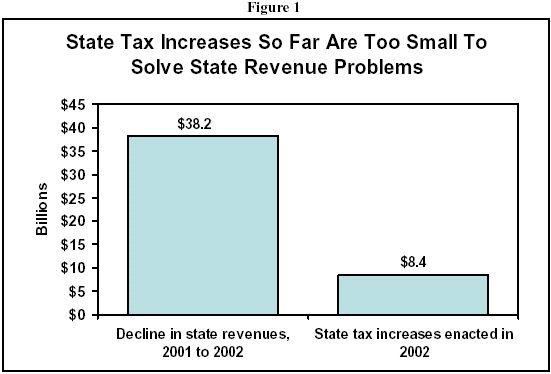

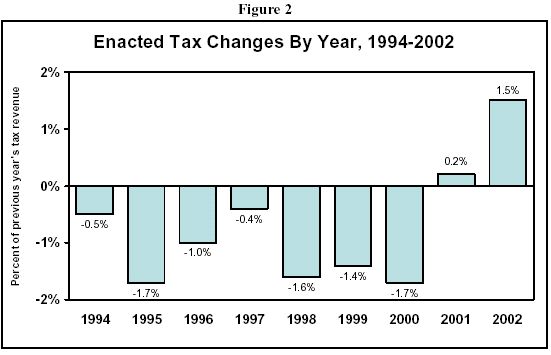

The State Tax Cuts Of The 1990s The Current Revenue Crisis And Implications For State Services 11 12 02

Jfk Jr S Will Page 2 Jfk Jr Jfk Words

Proposed Gift And Estate Tax Changes Mean Some May Need To Act Now Ruder Ware Jdsupra

Capital Gains Tax What Is It When Do You Pay It

Facts To Be Considered To Buy Your House In Massachusetts Facts Mindfulness Stuff To Buy

Federal Gift Tax Vs California Inheritance Tax

How Is Tax Liability Calculated Common Tax Questions Answered

Jfk Jr S Will Page 2 Jfk Jr Jfk Words

11 Estate Taxes And Inheritance Planning Faqs Taxact Blog

How Is Tax Liability Calculated Common Tax Questions Answered

How Is Tax Liability Calculated Common Tax Questions Answered

The State Tax Cuts Of The 1990s The Current Revenue Crisis And Implications For State Services 11 12 02

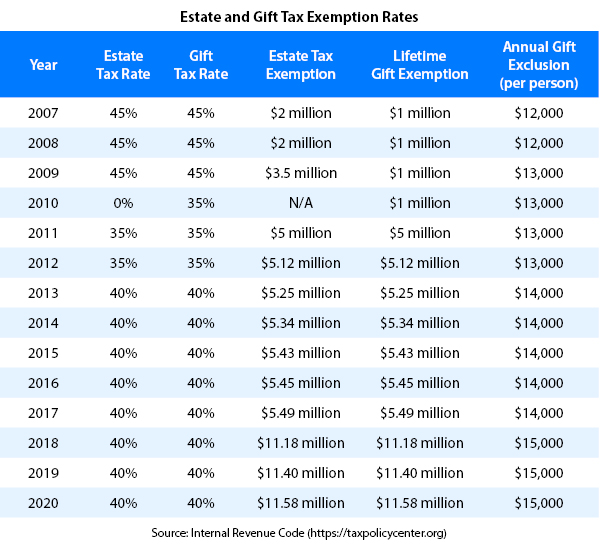

Can Making Lifetime Gifts Really Reduce Your Tax Liability In The Future

The State Tax Cuts Of The 1990s The Current Revenue Crisis And Implications For State Services 11 12 02

Can Making Lifetime Gifts Really Reduce Your Tax Liability In The Future